Report and publications

Our UK VC & Female Founders report, commissioned by Chancellor Philip Hammond at Budget 2017 and undertaken by the British Business Bank in partnership with Diversity VC and the BVCA, identifies specific barriers faced by female-led firms in accessing venture capital.

Key findings

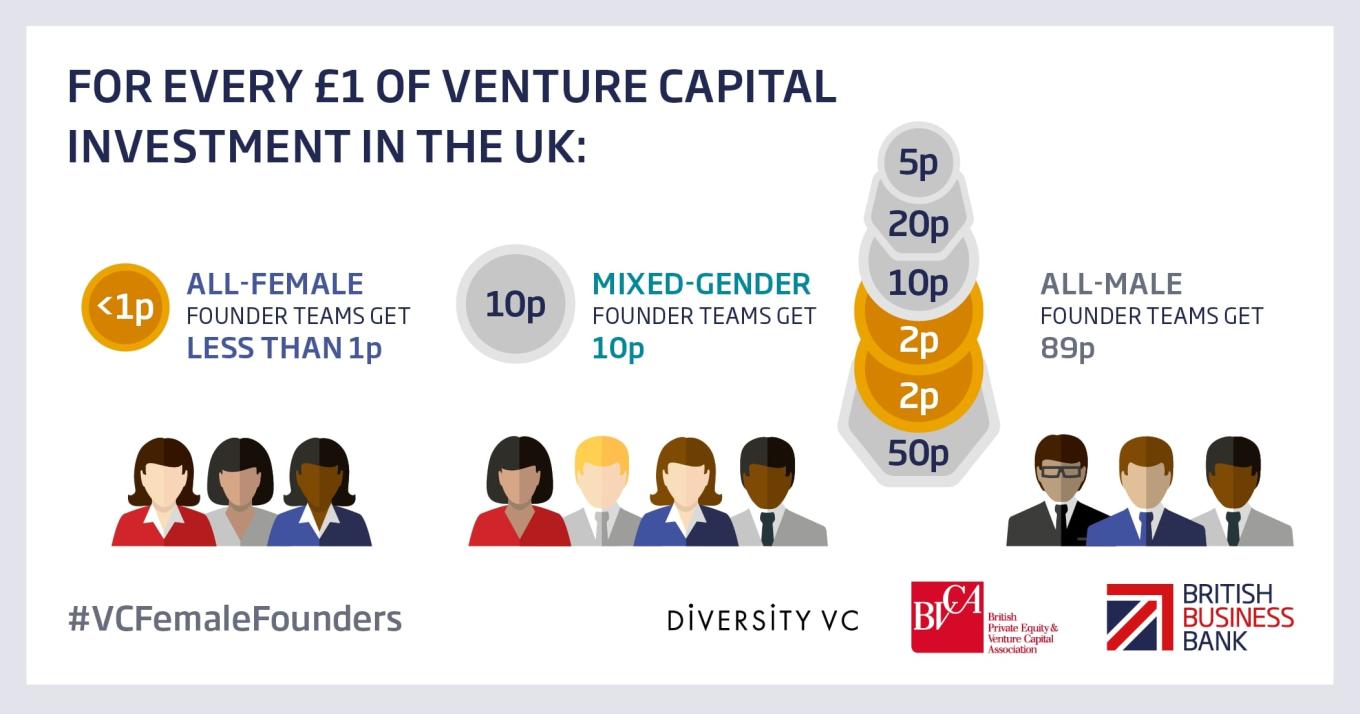

- for every £1 of venture capital (VC) investment in the UK, all-female founder teams get less than 1p, all-male founder teams get 89p, and mixed-gender teams 10p.

- venture capital investment in start-ups with female founders is increasing but progress is very slow. At current rates, for all-female teams to reach even 10% of all deals will take more than 25 years (until 2045).

- 83% of deals that UK VCs made last year had no women at all on the founding teams.

The British Business Bank and British Patient Capital are committed to supporting the VC industry in a number of ways, including by:

- Directing the £2.5bn British Patient Capital to be a ‘Catalyst and Champion’ for UK VC by leading on diversity and inclusion and other market-wide issues

- Investing in new fund managers with approaches and networks outside the norm

- Publishing research on diversity (including ethnicity) in the UK entrepreneurial population by the end of 2020

- Publishing research on progress made by the industry on this report’s actions by the end of 2020

- Serving as an independent ‘clearing house’ for VCs to share their data and initiatives

- Continuing to work with Diversity VC and BVCA, providing support for each other’s efforts

UK VC & Female Founders Report

Our UK VC & Female Founders report, commissioned by Chancellor Philip Hammond at Budget 2017 and undertaken by the British Business Bank in partnership with Diversity VC and the BVCA, identifies specific barriers faced by female-led firms in accessing venture capital.