Report and publications

The quarterly Markets Update provides an overview of the main developments in SME finance markets. It updates key data contained in the Small Business Finance Markets 2019/20 report for the period from April to June, where available. The Update highlights that the COVID-19 outbreak has had a major impact on the use of external finance by UK SMEs. Read footnote text 1

Small business confidence in the UK was broadly flat in Q2 2020 after weakening sharply in the previous quarter

The FSB Voice of Small Business survey for Q2 2020 showed that the confidence index was at -5.0. This is a weighted index based on how small businesses view their prospects over the next three months compared to the previous equivalent period. The index of -5.0 indicates that the share of small businesses viewing their prospects as worse was slightly larger than those expecting an improvement. Please note that the survey was conducted between late June and early July, which indicates it captures the response of small businesses to the easing of some restrictions associated with the COVID-19 outbreak such as the limited reopening of non-essential retailers and pubs, bars, restaurants. It also captures Coronavirus Business Interruption Loans opening for applications in late March and Bounce Back Loans in May.

In Q1 2020 the index was -143.4. This indicates that the share of small businesses viewing their prospects as worse was much larger than those expecting an improvement. Please note that this was conducted 13-23 March, capturing the initial response of small businesses to the outbreak but not the government support schemes coming into effect. It was also shortly before the government introduced the lockdown on 26 March to slow the spread of COVID-19.

Small business confidence index

-

Return to footnote location

1

This update contains data available up until 31 July 2020

The UK economy contracted at an unprecedented rate during Q2 2020 but there are early signs that it has started to grow again

Real GDP fell 19.1% in the three months to May compared to the previous equivalent period, according to the provisional estimate from the Office of National Statistics. This was the largest drop for a three-month period on record (the quarterly and rolling three-month data series began in 1955 and 1997 respectively). The decline was also much larger than the worst during the financial crisis (-2.1% in Q4 2008).All the headline sectors (services, production and construction) dragged on real GDP.

The largest decline was in construction (-29.8%), followed by services (-18.9%) and production (-15.5%).

Real GDP, quarterly and rolling three-month change

The ONS data also showed that real GDP rose 1.8% in May from the previous month. This followed a fall of 20.3% in April, the largest monthly decline on record. However, it is worth treating the monthly GDP data with caution because it can be subject to significant revisions.

Business investment dropped 0.3% in Q1 2020 compared to the previous quarter, according to the ONS. This followed a decline of a similar size in Q4 2019. By type of asset, falls in investment in other buildings & structures as well as transport equipment were partially offset by rises in information & communication technology equipment, and other machinery & equipment.

Business investment, quarterly change

The flash composite purchasing managers’ index for July, which measures manufacturing output and business activity in services against the previous month, signaled that activity in the private sector UK economy has begun to grow again at the start of Q3. The PMI rose to 57.1 from 47.7 in June. This was the third consecutive monthly rise but the first time that the PMI was above 50, the threshold for growth, since February.

The recent rises in the PMI are consistent with the easing of some restrictions associated with the COVID-19 outbreak. The PMI report noted that respondents commented on a gradual increase in business activity following the lockdown period during Q2, helped by returns to work and a phased reopening of the wider UK economy.

Key surveys signal that business investment remains very weak. The BoE Agents’ summary of business conditions for Q2 2020 (conducted mid-May to mid-June) reported that companies have mostly cancelled or postponed non-essential investment to preserve cash buffers, and many are uncertain when or whether investment plans will be reinstated. Contacts generally said they had cut investment spending by around half or more for companies most severely affected by the pandemic. Similarly, the British Chambers of Commerce Quarterly Economic Survey for Q2 2020 (conducted over the same period as the BoE Agents’ summary) showed that the net balance of firms expecting to increase investment in plant and machinery fell to the lowest since it started in 1989.

Officials and private sector forecasters expect the UK economy to contract this year by more than during the financial crisis. Uncertainty about the outlook is high because of the unprecedent nature of the COVID-19 outbreak. This has resulted in most forecasts recently being revised down. It has also led officials including the Office of Budget Responsibility, OECD and Bank of England to produce economic scenarios rather than forecasts.

The OBR recently produced three scenarios: upside, central and downside. The “upside” assumes that activity rebounds relatively quickly and there is no long-term damage to the economy. The “central”, which is what they view as the most probable, sees output recovering more slowly, with some enduring economic damage, ie real GDP in Q1 2025 is 3% lower than was forecast in March. The “downside” involves output recovering even more slowly, with real GDP in Q1 2025 6% lower than in the March forecast. The OECD has provided two scenarios that it considers to be equally likely: another major outbreak of COVID-19 is avoided or alternatively a second wave of infections with renewed lockdowns before the end of 2020. The BoE has produced a sole “plausible illustrative” scenario. All the official scenarios, along with the average of independent private sector forecasts (.PDF, 550 KB)(Opens in new window) compiled by HM Treasury, show the UK economy contracting this year by at least 9%.

This compares to real GDP falling during the financial crisis by 0.3% in 2008 and 4.2% in 2009.

| Official scenarios and private sector forecasts for UK real GDP | |||

|---|---|---|---|

| 2020 | 2021 | ||

| EY Item Club (July) | -11.5% | 6.5% | |

| OBR “central” scenario (July) | -12.4% | 8.7% | |

| Average of independent forecasts (July) | -9.1% | 6.6% | |

| Oxford Economics forecast (July) | -10.9% | 10.3% | |

| IMF forecast (June) | -10.2% | 6.3% | |

| OECD "no second major outbreak" scenario (June) | -11.5% | 9.0% | |

| OECD "second major outbreak" scenario (June) | -14.0% | 5.0% | |

| BoE “illustrative” scenario (May) | -14.0% | 15.0% |

Most of the official scenarios see a sharp decline in the economy in 2020 followed by a reasonably quick bounce back next year. In contrast, the average of independent private sector forecasts shows an economic contraction this year that is less severe and weaker growth in 2021 than the official scenarios.

In the OBR “central” scenario, UK real GDP is expected to return to its pre-COVID-19 level by the end of 2022. However, the latest forecast from the EY Item Club, which is among those of independent private sector forecasters compiled by HM Treasury and it one of the few private sector forecasters that provides details of when real GDP is expected to return to its pre-COVID-19 level, shows the level of real GDP not returning to its pre-COVID-19 level until the end of 2024.

Gross bank lending to SMEs has surged in line with loan approvals under Government Support Schemes

Based on the BoE Bankstats data for June, the most up-to-date on actual drawdowns, gross bank lending (which includes term loans and credit cards but excludes overdrafts) to SMEs in the first six months of this year was more than double that in the same period of 2019. In 2020-to-date, the total value of gross lending was £62 billion on seasonally adjusted basis.

Gross bank lending (excluding overdrafts) to SMEs

Data from HM Treasury on coronavirus funding for business shows the higher gross lending was driven by the use of government guarantee schemes (BBLS and CBILS) designed to support SMEs during the COVID-19 crisis. The total value of BBLS and CBILS approvals in May was £26 billion while Bankstats shows drawdown gross lending was £25 billion, up 327% from the previous month and the largest by far since the data series began in 2011. In June gross lending was £16.2 billion (s.a.), down 35% from the previous month but still the second largest monthly value on record. The total value of BBLS and CBILS approvals in June was around £10 billion.

The BoE Agents’ summary for Q2 2020, conducted from mid-May to mid-June, in addition to noting high demand for credit at the time reported that it was expected to increase as companies start to re-open over the coming months. However, the BoE Agents’ summary flagged that many small companies are reluctant to increase their borrowing, often because they already have high levels of debt, are concerned they will struggle to repay loans, or are reluctant to encumber their assets.

The BoE Agents’ summary also found that banks continued to offer flexibility on covenants, payment holidays and rolling over existing facilities. However, it noted banks were reported to be wary of increasing their own exposure by extending new loans to companies in vulnerable sectors.

Turning to SME loan repayments, the total value in the first six months of this year was around £31 billion (s.a.), the highest on record and up 12% from the corresponding period last year.

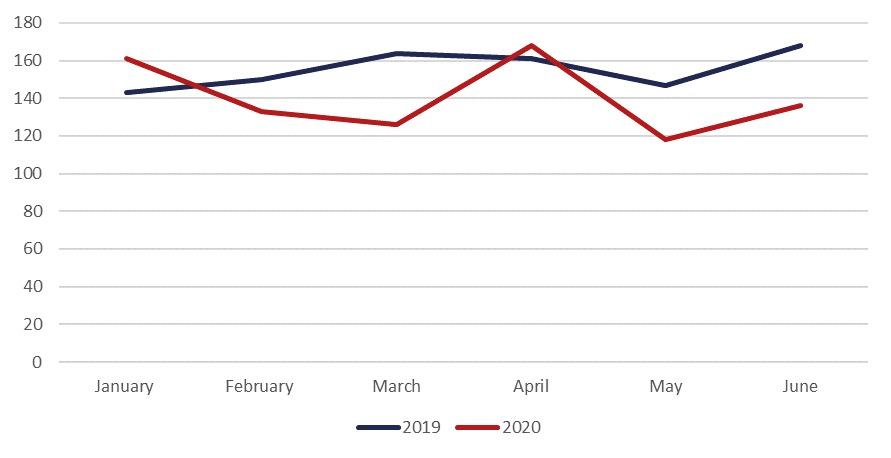

Loan repayments by SMEs from January to June each year

The higher value of loan repayments was largely driven by increases in May and June. In May the total value of repayments was £5.4 billion, up around 11% from the previous month. In June repayments totalled £5.6 billion, around 4% higher than in the previous month and a 16-month high. The recent strength of repayments is consistent with anecdotal reports that a small proportion of SMEs are substituting cheaper government-backed loans such as BBLS and CBILS for pre-existing debt.

Gross bank lending to SMEs in the first six months of this year exceeded loan repayments, resulting in positive net lending of £31.6 billion. This was the largest since the data series began and up significantly from the positive net lending of £0.9 billion in the same period of 2019.

The utilisation of overdrafts has fallen to a record low amid anecdotal reports of a small proportion of SMEs substituting cheaper Government-backed loans

Calculations by the British Business Bank based on UK Finance data from the seven largest UK banks indicate that the rate of overdraft utilisation by SMEs fell in May for the third consecutive month to 41%, a series low, from 48% in the previous month. This was the largest drop on record.

The overdraft utilisation rate and value of overdraft drawdowns and facilities available

The total value of overdraft facilities approved or increased in May was £507 million, down 53% from April. The total value of overdraft drawdowns also fell in May to £6.7 billion (n.s.a.). This was down around 14% from the previous month and a record low. The value of overdraft drawdowns typically falls in March, April and May each year, but the declines in these months in 2020 were larger than in previous years. Similarly, the British Business Bank’s market contacts have noted a decrease in the utilisation of invoice finance, a further product often considered alongside overdrafts when addressing working capital needs. The falls in overdraft and invoice finance utilisation are again consistent with reports that a small proportion of SMEs are using BBLS and CBILS instead of more expensive types of lending.

Asset finance has weakened sharply as SMEs cut back investment, while there is limited data on marketplace lending in 2020-to-date

Asset finance to SMEs weakened considerably amid the COVID-19 restrictions. Total SME asset finance new business (largely leasing and hire purchase) was £5.8 billion in first five months of this year, according to our estimates based on Finance & Leasing Association data. This was down 30.4% from the same period of 2019.

The weakness is consistent with ONS data and business surveys reporting that SMEs have cut investment sharply amid the outbreak. A further issue for the non-bank lenders in the sector, which accounted for just over a third of asset finance lending in 2019, is that some are facing challenging funding conditions of their own. Many have been unable to participate in or access various government and Bank of England schemes in the same way banks have been able to.

In relation to marketplace business lending, there is limited data available for 2020. This is in part due to Funding Circle now only reporting loan origination every six months following its public listing. Lending in Q1 2020 will have been mostly unaffected by the outbreak. However, from Q2 onwards, it is highly likely those that have not been able to lend via the various government schemes such as BBLS and CBILS will have seen a significantly reduced origination and significant requests for payments holidays from existing borrowers.

UK equity finance has remained active, but it is too early to understand the full impact of Covid-19

Our Small Business Equity Tracker report shows that there were 420 announced equity deals in UK SMEs in Q1 2020 with an investment value of £2.4 billion. The number of reported deals in Q1 was down 15% compared to Q4 2019 and 8% from Q1 2019. However, investment was 36% higher than in Q4 2019.

British Business Bank analysis of Beauhurst data indicates that in Q2 2020 there were 422 announced equity deals in UK SMEs with an investment value of £1.6 billion. The number of reported deals is broadly flat on Q1 2020 but down 11% on Q2 2019. The investment value is also down 32% compared to Q1 2020 and 9% on Q2 2019. The deals in Q2 would mostly have already been in progress before the lockdown began though some may also have been due to investors supporting their existing portfolio.

Deal activity in April was strong with 168 deals completed – this is 4% higher than in the same month of 2019 and up 26% from the 133 completed in February, the last full month before the COVID-19 pandemic escalated in the UK and lockdown restrictions were introduced on 26 March. However, the number of equity deals declined in May and June, with 118 and 136 deals reported respectively. Both months are down around 20-30% on April 2020, while being around 20% lower on the same months in 2019. This may potentially indicate investors becoming more cautious, however monthly equity activity is volatile and it is still too early to understand the full impact of the COVID-19 crisis on equity and we will continue to monitor these trends carefully.

Number of announced equity deals in UK SMEs per month

Data tables

Aggregate flow and stock of finance to smaller businesses, £ billions

The following table brings together the latest data available as at 29 June from multiple sources, to present a snapshot of the current values of various types of external finance – and the number of reported deals for equity investment – provided to UK smaller businesses.

Our 2019/20 Small Business Finance Markets (.PDF, 850.02 KB)(Opens in new window) report looks at market developments in more detail including regional comparisons and deeper dives into the demand side.

| 2016 | 2017 | 2018 | 2019 | YTD 2020 | YTD change on previous year | ||

|---|---|---|---|---|---|---|---|

| Bank lending stock Source: BoE | Outstanding amount £bn | 166 | 165 | 166 | 168 | 200 (Jun) | +19.1% |

| Bank lending flows Source: BoE | Gross flows £bn (a) | 59 | 57 | 58 | 57 | 61.9 (Jun) | +121.3% |

| Other gross flows of SME finance | |||||||

| Private external equity investments Source: Beauhurst | Investment value £bn | 4.0 | 6.5 | 6.9 | 8.5 | 4.0 (Jun) | -12.7% |

| No. of reported deals | 1566 | 1784 | 1758 | 1832 | 842 (Jun) | -9.8% | |

| Asset finance flows £bn Source: FLA | 17.0 | 19.0 | 19.4 | 20.1 | 5.8 (May) | -30.4% | |

| Marketplace business lending flows Source: Brismo and British Business Bank calculations | 1.4 | 2.0 | 2.4 | 2.5 | NA | NA |

The information contained in this table should be viewed as indicative as data and definitions are not directly comparable across different sources. There can be some double counting across estimates in different parts of the table. Flows data are cumulative totals for the year or to the date stated. Non-seasonally adjusted.

(a) Data exclude overdrafts and covers loans in both sterling and foreign currency, expressed in sterling and not seasonally adjusted.

Latest data available as at 31 July.

Small business confidence

The table below contains historical data for the FSB Small Business Index.

| 2017 | 2018 | 2019 | 2020 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 | Q3 | Q4 | Q1 | Q2 |

| 20 | 15 | 1.1 | -2.5 | 6 | 12.9 | -1.7 | -9.9 | -5 | -8.8 | -8.1 | -21.6 | -143.4 | -5.0 |